feliciavaude0

About feliciavaude0

The Best Ways to Invest in Gold: A Comprehensive Guide

Investing in gold has long been considered a safe haven for wealth preservation and a hedge against inflation and economic uncertainty. As a tangible asset, gold has intrinsic value and has been used as a form of currency for thousands of years. In this article, we will explore the best ways to invest in gold, examining the various methods, their benefits, and potential drawbacks, to help you make informed investment decisions.

Understanding Gold as an Investment

Before diving into the different methods of investing in gold, it is essential to understand why gold is a popular investment choice. Gold is seen as a store of value, particularly during times of economic instability. Its price tends to rise when the value of paper currencies falls, making it an attractive option for investors looking to protect their wealth. Here is more information regarding buynetgold review our own page. Additionally, gold has a low correlation with other asset classes, which can help diversify an investment portfolio.

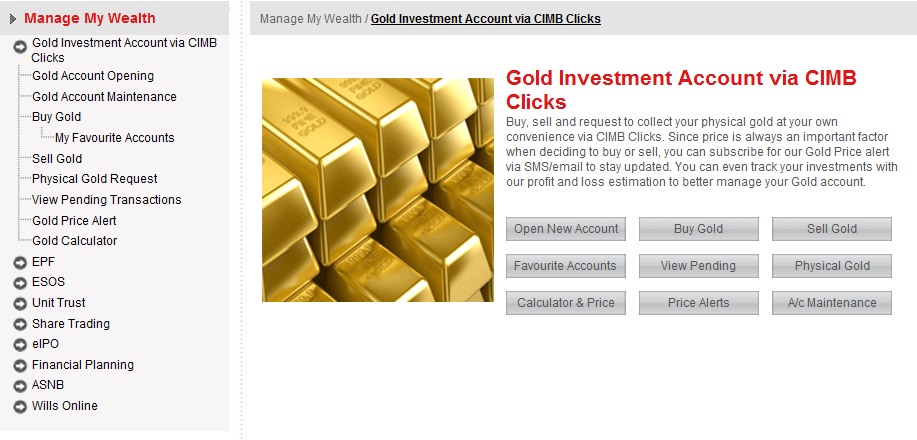

1. Physical Gold

One of the most straightforward ways to invest in gold is by purchasing physical gold in the form of bullion bars, coins, or jewelry. Here are some key points to consider:

Benefits:

- Tangible Asset: Owning physical gold means you have a tangible asset that you can hold in your hand.

- No Counterparty Risk: Physical gold does not rely on any financial institution, reducing the risk associated with counterparty failure.

Drawbacks:

- Storage and Security: Physical gold requires secure storage, which may involve additional costs for safes or safety deposit boxes.

- Liquidity: Selling physical gold can take time and may involve transaction costs.

2. Gold ETFs (Exchange-Traded Funds)

Gold ETFs are investment funds that trade on stock exchanges and aim to track the price of gold. They offer a convenient way to invest in gold without the need for physical storage.

Benefits:

- Liquidity: Gold ETFs can be bought and sold easily on stock exchanges, providing liquidity similar to stocks.

- Low Expense Ratios: Many gold ETFs have low fees compared to other investment vehicles.

Drawbacks:

- Management Fees: While generally low, there are still management fees associated with gold ETFs that can affect overall returns.

- No Physical Ownership: Investing in gold ETFs does not grant you ownership of physical gold, which may be a concern for some investors.

3. Gold Mining Stocks

Investing in gold mining companies is another way to gain exposure to gold. When you buy shares of a gold mining company, you are investing in the company’s ability to extract and sell gold.

Benefits:

- Potential for High Returns: Gold mining stocks can offer higher returns than physical gold, especially if the price of gold rises significantly.

- Dividends: Some gold mining companies pay dividends, providing an income stream.

Drawbacks:

- Market Risk: Mining stocks can be volatile and are subject to market fluctuations that may not correlate with gold prices.

- Operational Risks: Mining companies face various operational risks, including labor disputes, regulatory changes, and environmental concerns.

4. Gold Futures and Options

Gold futures and options are contracts that allow investors to speculate on the future price of gold. Futures contracts obligate the buyer to purchase gold at a predetermined price, while options give the buyer the right, but not the obligation, to buy gold at a specified price.

Benefits:

- Leverage: Futures and options allow investors to control a large amount of gold with a relatively small investment, potentially amplifying returns.

- Flexibility: These contracts can be used for hedging against price fluctuations or for speculative purposes.

Drawbacks:

- Complexity: Futures and options trading can be complex and may not be suitable for inexperienced investors.

- Risk of Loss: The use of leverage can amplify losses, making this approach riskier than other forms of gold investment.

5. Gold Certificates

Gold certificates are documents issued by banks or financial institutions that represent ownership of a specific amount of gold. They can be an alternative to holding physical gold.

Benefits:

- Convenience: Gold certificates eliminate the need for storage and security concerns associated with physical gold.

- Liquidity: They can be easily bought and sold in the market.

Drawbacks:

- Counterparty Risk: Investing in gold certificates involves relying on the issuing institution, which introduces counterparty risk.

- Limited Availability: Gold certificates may not be as widely available as other investment options.

6. Gold IRA (Individual Retirement Account)

A Gold IRA is a self-directed retirement account that allows investors to hold physical gold and other precious metals as part of their retirement portfolio.

Benefits:

- Tax Advantages: Gold IRAs offer tax benefits similar to traditional IRAs, allowing for tax-deferred growth until retirement.

- Diversification: Including gold in a retirement account can help diversify an investment portfolio.

Drawbacks:

- Setup and Maintenance Costs: Gold IRAs may involve higher fees and costs for setup and maintenance compared to traditional IRAs.

- Regulations: There are specific IRS regulations regarding the types of gold that can be held in a Gold IRA.

Conclusion

Investing in gold can be an effective strategy for wealth preservation and diversification. Each method of investing in gold has its advantages and disadvantages, and the best approach will depend on your individual financial goals, risk tolerance, and investment horizon. Whether you choose to invest in physical gold, ETFs, mining stocks, futures, certificates, or a Gold IRA, it is essential to conduct thorough research and consider seeking advice from financial professionals. By understanding the various avenues for gold investment, you can make informed decisions that align with your overall investment strategy and financial objectives.

No listing found.